Contents:

Elections can mean a change of policy that could bring headwinds or tailwinds for business, international tension could bring tariffs and more. Please note that the composition of an index is not set in stone and will change from time to time. And it is the performance of these shares that determines the value of an index.

Commitments of Traders CFTC.

Posted: Tue, 20 Sep 2011 04:56:56 GMT [source]

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 71.6% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Please ensure you what are undervalued stocks fully understand the risks involved by reading our full risk warning. Trading leveraged products such as Forex and CFDs carries a high level of risk and may not be suitable for all investors. Before trading, you should fully understand the true extent of your exposure to the risk of loss and your level of experience.

Market mostly traded in tight ranges ahead of Jerome Powell’s highly anticipated testimony to the House, which has the potential to be a volatile event. In the wake of the implosion of SVB, traders are dialing down their expectations for Fed hawkishness next week… ECB provided no forward guidance and/or commitment to future hikes… Buying will give you a position that makes money if Wall Street rises, selling will earn you profit if Wall Street falls. On the FOREX.com platform, for example, you can trade over 15 of the world’s indices as a CFD.

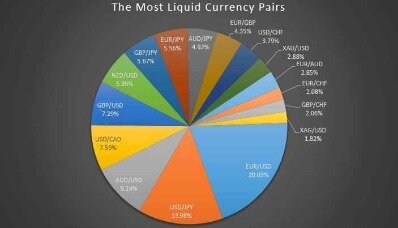

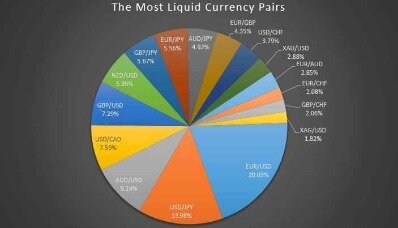

The ECB had already planned a half-point rate move in March, and these stronger readings are likely to bolster officials who say that more big moves are needed beyond that to get inflation under control. Experience award-winning platforms with fast and secure execution, and enjoy tight spreads from 0.5 pts on FX and 1 pt on indices. After a combined 425 basis points worth of hikes, the BOC has already signaled it would pause tightening to let the economy digest impact of previous hikes. In this week’s report, we are getting technical on S&P, gold and GBP/USD. With the US CPI and ECB decision to come amid all uncertainty from the SVB fallout, the EUR/USD is clearly one of the most important FX pairs this week. VT Markets LLC is registered under Saint Vincent and the Grenadines Financial Services Authority with registration number 673 LLC 2020.

Unlike shares and forex, an index is just a calculation – there’s no actual asset to buy and sell. However, several financial derivatives exist that let you take a position on index prices without requiring you to buy 100 or more stocks. According to the CME’s FedWatch tool, investors are now pricing in a 60/40 shot of a 50bps rate hike in two weeks’ time and that rates could peak above 5.5%.

CFD Cash Rebates CFD Trading.

Posted: Thu, 29 Jun 2017 19:40:53 GMT [source]

However, the information is subject to change at any time without notice. VT Markets cannot guarantee or assume any legal responsibility for the relevance, accuracy, timeliness, or completeness of the information. Please confirm, that the decision was made independently at your own exclusive initiative and that no solicitation or recommendation has been made by FP Markets or any other entity within the group. Employment data, central bank announcements and inflation rates all offer clues to how an economy is performing – and demand for shares in strong economies is often higher. Price-weighted indices use a company’s share price to determine how much it moves the index. This means that companies with higher share prices will have a greater influence on these indices.

ChatGPT has several limitations to trading live markets, but there are other AI options designed specifically for traders who want to start algo trading. Well done, you’ve completed Trading indices, lesson 1 in Introduction to financial markets. Market capitalisation indices use the total market value of a company’s outstanding shares to assess how much it affects the index. This means that more valuable companies will have more of an impact on the index’s daily movements. Hot inflation is likely to outweigh concerns over financial stability, potentially leading the ECB to disappoint market’s substantial re-pricing of policy rates.

Buying a single CFD will earn you £1 each time Wall Street moves one point. To calculate the value of a price-weighted index, you add the share price of each stock together and divide by the total number of stocks. The FTSE 100 and USD/CAD have piqued our interest for potential bullish setup this week. An initial glance at RBA’s statement suggests they are nearing the end of the tightening cycle, and perhaps one step closer to publicly discussing a pause.

VT Markets Ltd is an authorised Financial Service Provider registered and regulated by the Financial Sector Conduct Authority of South Africa under license number 50865. VT Markets is a brand name of different entities authorised and registered in various jurisdictions. The information or services on this website is not directed or offered to residents of certain jurisdictions such as the United States, North Korea etc.

Should you wish to proceed, please confirm that your decision was made independently and at your own exclusive initiative and that no solicitation has been made by IC Markets Global or any other entity within the Group. If the RBA deliver another 25bp hike tomorrow, it will take their cash rate to a 10-year high of 3.6%. On the back of a 25bp hawkish hike, https://day-trading.info/ with hypothesized the potential for the RBA to be nearing a pause. Less than 24 hours later, Governor Lowe comes right out and says it. The SNB has swept in to provide much needed liquidity to Credit Suisse, which should soothe some concerns over risk to the financial system. The number of CFDs you trade dictates how much profit or loss you make.

StoneX Europe Ltd products, services and information are not intended for residents other than the ones stated above. Search for Wall Street in the platform and click the market to open a deal ticket. You’ve heard news that two major companies are considering a merger. As a result, you think the Dow Jones will rise, so you decide to take a long position on Wall Street.

Sign up for a demo account to hone your strategies in a risk-free environment. The information displayed through the IC Social application is not intended for any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. The website you are visiting now is operated by Raw Trading Ltd (“IC Markets Global”), an entity that is not established in the European Union or regulated by an EU National Competent Authority. Based on your location, one of our other licensed companies may be better suited to you.

FOMC meetings are some of the most important economic policy events. The meetings provide opportunities for both day traders and longer-term traders. To close your position, you make a trade that is the opposite to when you opened. We bought five CFDs at the outset, so now we can sell five Wall Street CFDs to realise any profits or losses. The information on this website is of a general nature only and does not consider your goals, financial situation or needs.

Please note that past performance does not constitute a reliable indicator of future results. Future forecasts do not constitute a reliable indicator of future performance. Information displayed through the IC Social application shall not be construed as containing investment advice or an investment recommendation or, an offer of or solicitation for any transactions in financial instruments. Past performance is not a guarantee of or prediction of future performance. Any analysis displayed through the IC Social application does not constitute a personal recommendation and does not consider your personal investment objectives, investment strategies, financial situation or needs.